Wedding Insurance

Wedding insurance exists to protect you from liability that could happen on your big day. Examples include a slip and fall on the dance floor, damage to the venue, or damages associated with a guest being overserved. We can also provide event cancellation insurance, which covers deposits forfeited to vendors, gifts, jewelry, attire, and expenses incurred to re-take photographs or re-shoot video of the event. Additionally, most wedding ceremonies or reception sites require Event Liability insurance, and our policy is designed to specifically address those requirements!Remove one less item from your wedding day to-do list by using our quick and easy online application to receive wedding insurance proof of coverage in minutes!Premiums start at $175, for protection for the bride, groom and parents.

The PHLY Difference

$0 deductible

Policy limits meet most venue minimum insurance requirements

General Liability: $1,000,000 per occurrence / $3,000,000 aggregate limit

Bodily Injury/Property Damage

Host Liquor Liability included

Easy online application! Instant quote for most events

Additional Benefits:

Pay online and your policy documents are e-mailed to you within minutes

General Liability premiums start at $175 and vary based on event type and size

Liquor Liability (Optional coverage)

Damage to Premises rented to you

Hired and Non Owned Auto coverage also available

Terms are defined in the Glossary of Insurance Terms located below.

FAQs

What is Special Event Insurance?

Special Event Insurance is generally purchased to protect the named Insured from lawsuits arising out of Bodily Injury or Property Damage to third parties at your event. Most venues will require you to purchase this coverage and add them as Additional Insured to your policy which is provided under our Special Events coverage.

What does event cancellation insurance cover?

Event cancellation/postponement

If you have to cancel or postpone your event, you will be reimbursed in excess of the deductible, for all deposits made and other charges paid or contracted to be paid for: transport, catering services, property and equipment rentals, hall and location rentals, accommodations (including travel arrangements and accommodations for a honeymoon, if applicable), attire, jewelry, flowers, photographer and videographer services, and entertainment expenses.*

Unanticipated related expenses

Pays for additional expenses necessary to avoid the cancellation or postponement of the event.

Photographer/Videographer

Pays for expenses related to re-shooting photographs or video due to a no-show vendor, or loss of media files before delivered to you.

Gifts

Pays of loss or damage to gifts occurring at the event site or insured home 7 days before - 7 days after the event.

Attire

Pays for loss or damage of attire for the special event.

Jewelry

Pays for loss or damage of jewelry within 7 days prior to the special event.

Cessation of Operations

Reimburses deposits paid for vendors who go out of business.

Counseling

Pays for counseling recommended by a physician for up to 1 year following the cancellation or postponement of the event.

Why do I need event cancellation insurance?

A wedding may be one of the largest expenses of your lifetime. You can protect your investment in your wedding, or other special event with event cancellation insurance. This coverage provides protection for the necessary postponement or cancellation of your special event, so you can recoup deposits made to vendors and other necessary expenses.

What is Host Liquor Liability Insurance?

Liability for bodily injury (BI) or property damage (PD) arising out of the serving or distribution of alcoholic beverages by a party not engaged in this activity as a business enterprise. Host liquor liability exposures are insurable under standard general liability policies. Our liability policy only excludes liquor liability coverage if the named insured on the policy is "in the business" of manufacturing, selling or distributing alcoholic beverages.

How far in advance should I purchase my policy?

Our quotation is good for 30 days however a Special Event Liability Event Policy must be purchased at least 24 hours before your event. As soon as you've selected a date and started putting down deposits. With our easy online application you'll have your proof of coverage in minutes so you can file it away and rest easy knowing you have protection as you continue selecting (and paying) vendors.

Who is protected under an Event Liability policy?

The policy protects the person or organization under whose name it was purchased (the "Named Insured"). Your event venue(s) can also be added as Additional Insured. Please note that you cannot add vendors (for example, caterers or musicians) under this policy. Any vendors at your event should have their own liability insurance.

Who is the carrier?

Philadelphia Indemnity Insurance Company. Rated "A++" (Superior) by the A.M. Best Company for financial stability. PHLY has received several business honors that highlight their financial strength, customer service, and positive work environment.

What is the refund policy for the Special Event Liability Insurance Policy?

Policy premiums, taxes, and other charges are fully earned at inception of policy coverage and are non-refundable in the event of cancellation of coverage at any time by the insured.

My venue requires me to show evidence of liability insurance. Is a Special Event Liability Insurance Policy suitable for this?

Yes, a Special Event Liability Policy allows you to name your event venue as additional insured.

Can I add my vendors (photographer, DJ, musicians, etc.) to my liability policy as insureds or can I purchase a policy in their name?

No. Special Event Liability insurance affords coverage to the Named Insured. The owners and/or lessors of premises, lessors of leased equipment, sponsors or co-promoters sponsors, promoters and co-promoters is the only entity that can be added to the certificate as an additional insured.

How do I make changes to my policy?

Please contact us at info@eventsins.com if you need to make a change to your policy

What do I do if I have a claim?

You should file a claim with Philadelphia Insurance Companies as soon as you are aware of an incident. Our online Report A Claim Form allows you to file your claim in just minutes and is available 24/7 on our website www.phly.com. Our Claims Customer Service number is 800.765.9749 and is available Monday-Friday 8:30am-8:00pm ET.

What are my coverage options?

For Special Event Liability Insurance, we offer Limits of Liability of $1,000,000 each occurrence/$3,000,000 aggregate.

Is there a deductible?

There is not a deductible for Event Liability (General Liability) Insurance coverage.

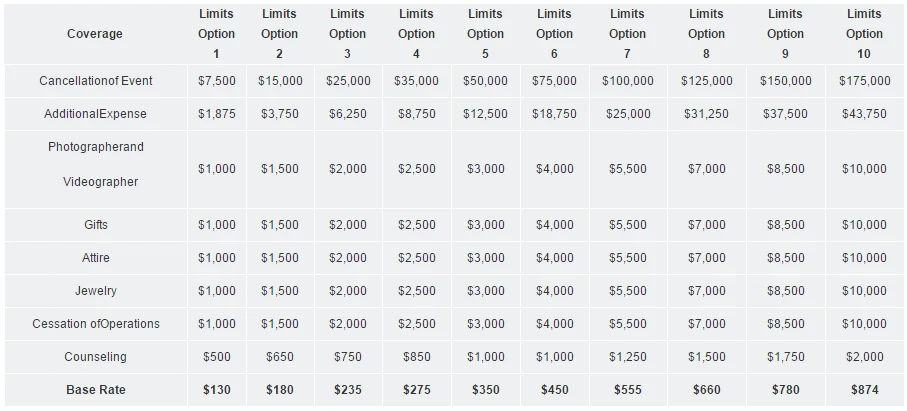

How much Event Cancellation / Postponement insurance do I need?

While we can't advise exactly which limit is right for your special event, you should choose your level of coverage based on the total budget of your event.

Does weather affect my Event Cancellation / Postponement coverage?

You will have coverage if an extreme weather event causes the venue to no longer be safe or usable. You will also have coverage if extreme weather prevents an insured, or at least 50% of the attendees from making the event. Our underwriting guidelines currently do not allow us to insure an outdoor venue that does not have a backup plan in the case of mild weather.

Who is covered?

The named insured as well as any named honorees on the policy. You also have the option to add an additional insured if this is required by the venue.

What if I have already made deposits or purchases for my event? Will they still be covered?

Yes, so long as you're not aware of a situation that could lead to a claim or suit when you apply for the policy.

Does an Event Cancellation / Postponement Insurance Policy cover events outside the United States?

The coverage territory is the United States and its territories and possessions. However, events taking place on cruise ships leaving Puerto Rico and Canadian ports to the United States are insurable events. All other events must take place within the United States or its territories.

Does Event Cancellation Insurance provide any coverage for my honeymoon expenses?

As unfortunate as it is when a honeymoon is cancelled, unforeseen life events do arise. In terms of recouping honeymoon expenses, we will reimburse you in excess of your deductible for all deposits forfeited through the planning of your honeymoon, as long as the cancellation is due to a covered postponement. View the policy specimen for more information: Special Events Cancellation Coverage

Does Event Cancellation / Postponement Insurance provide coverage for illness/injury to the honorees?

Yes, the policy will provide coverage for illness/injury to an honoree under the condition that the illness/injury has not been treated or known about within one year of the policy's effective date.

Will an Event Cancellation / Postponement Insurance Policy provide coverage if military leave is withdrawn due to unexpected deployment?

No, unfortunately, the policy will not cover a person's non-appearance due to their military deployment.

How do I purchase a Special Events Liability/Cancellation policy?

Applying for coverage is easy with CPH! You can submit your application online within minutes at www.cphins.com/special-event-insurance/ . Our online application allows you to purchase coverage using a Visa, MasterCard, and Discover (if approved). Your coverage documents will be presented immediately for download as soon as the purchase is complete, and we'll email you a copy as well.

How do I pay for coverage?

You will be asked to pay upon completing your application. We accept Visa, MasterCard, and Discover.

Is your website secure for purchasing insurance?

Yes. Our online web system uses "SSL", a security system that uses a bit of code on your web server that provides security for online communications. When a web browser contacts your secured web site, the SSL certificate enables an encrypted connection universally used by all secure websites. The system also does not keep credit card information, so after your card is charged your personal information will be deleted.